st louis county sales tax 2020

The minimum combined 2022 sales tax rate for St Louis County Minnesota is. Lowest sales tax 4725 Highest sales tax 11988 Missouri Sales Tax.

Missouri Sales Tax Small Business Guide Truic

The sales tax jurisdiction.

. There is no applicable county tax or special tax. 2020 rates included for use while preparing your income tax deduction. The total sales tax rate in any given location can be broken down into state county city and special district rates.

NO LAND TAX SALE. What is the sales tax rate in St Louis County. Missouri has a 4225 sales tax and St Louis County collects an.

Sales Tax Table For St. 012020 - 032020 - PDF. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local.

Statewide salesuse tax rates for the period beginning January 2020. 2022 List of Missouri Local Sales Tax Rates. 15 baths 1095 sq.

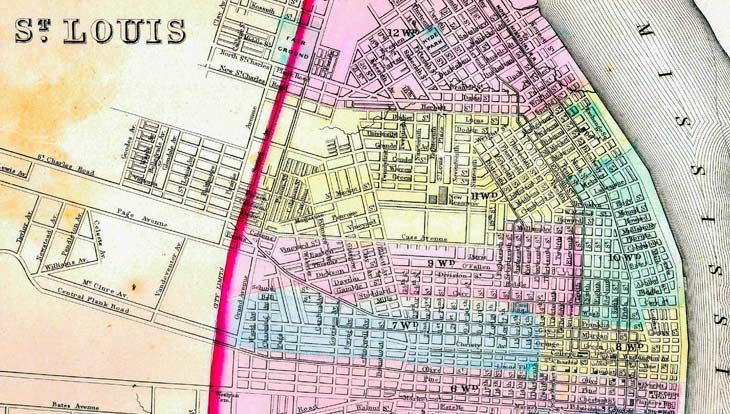

Louis county tax-forfeited land sale auctions. 41 South Central Avenue Clayton MO 63105. Download all Missouri sales tax rates by zip code.

Louis County Public Safety Sales Tax Quarterly Report Restated 2020 Quarter 3 Beginning Balance 07012020 21614616 Revenue Received 12214364 Expenditures Family Court. Persons making retail sales collect the sales tax from the. This is the total of state and county sales tax rates.

Louis County Missouri Tax Rates 2020. 2020 rates included for use while preparing your income tax. St louis county sales tax 2021.

This rate includes any state county city and local sales taxes. The minimum combined 2022 sales tax rate for St Louis County Missouri is. Louis MO 63103 sold for 142000 on Mar 21 2018.

The total sales tax rate in any given location can be broken down into state county city and special district rates. This is the total of state and county sales tax rates. Sales are held on the 4th floor of the Civil Courts Building at 10 N Tucker Blvd.

Minnesota has a 6875 sales tax and St Louis County collects an. All sales of tangible personal property and taxable services are generally presumed taxable unless specifically exempted by law. This rate includes any state county city and local sales taxes.

Online auction continues October 13 through November 10 2022 at 1100 am. Statewide salesuse tax rates for the period beginning February 2020. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 873 in St.

April 19 2022 Published Dates. The latest sales tax rate for Saint Louis MO. Condo located at 2020 Washington Ave 711 St.

Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district. The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects. Sales Dates for 2022 Sale 208.

View sales history tax history home value estimates and overhead. The latest sales tax rate for Saint Louis County MO. Land Tax sales this year are held 5 times a year in April May June July and August.

The Missouri state sales tax rate is currently. Louis County Board enacted. Average Sales Tax With Local.

Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. Monday - Friday 8 AM - 5 PM. April 5 2022 and.

Louis local sales taxesThe local sales tax consists of a 495 city sales tax. The combined rate used in this. Land Tax sales are held 5 times in 2022.

The 9679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax and 5454 Saint Louis tax.

Our History Metropolitan St Louis Sewer District

5918 Pershing Ave St Louis Mo 63112 Redfin

St Louis Mortgage Banking Northmarq

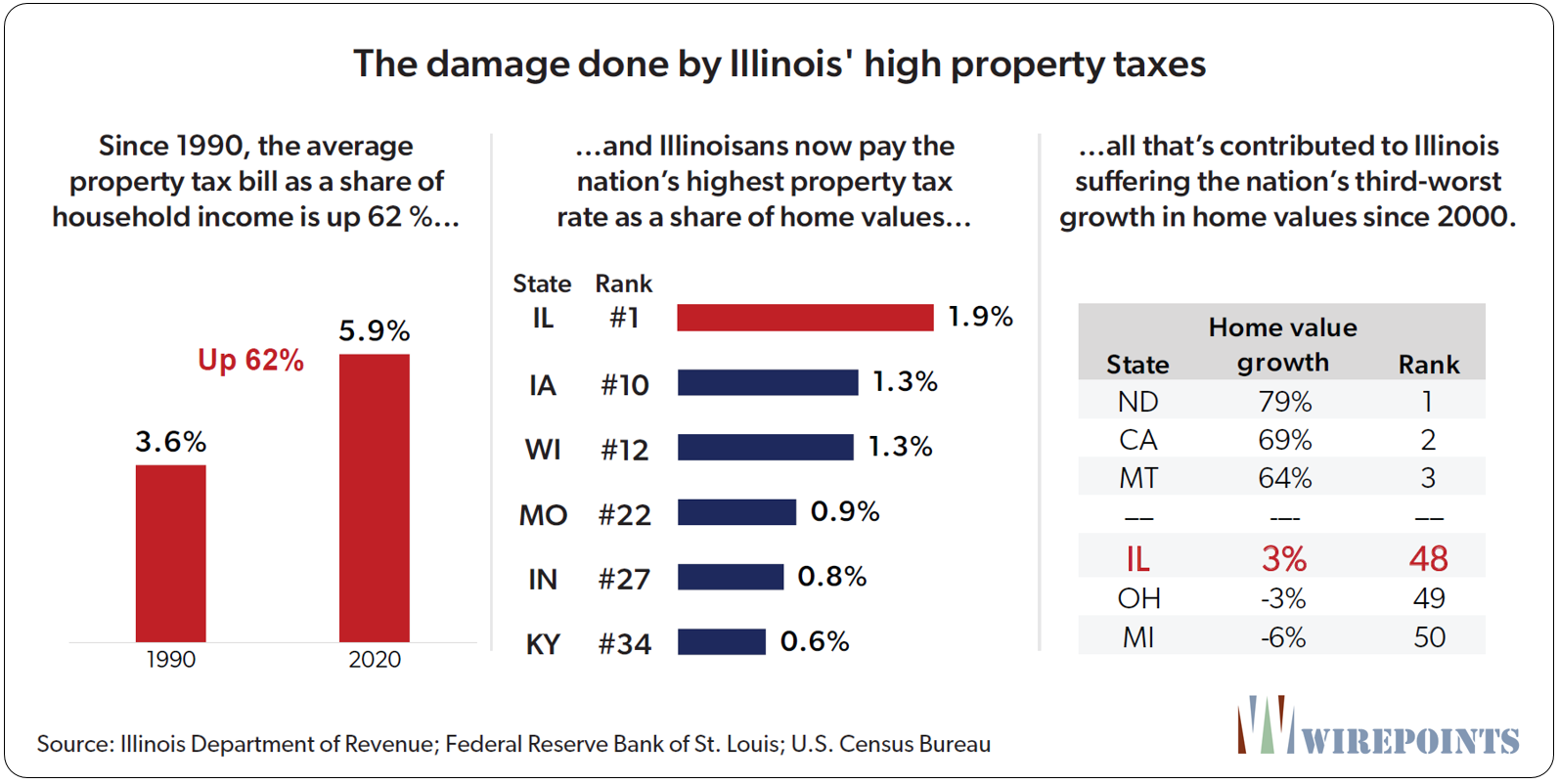

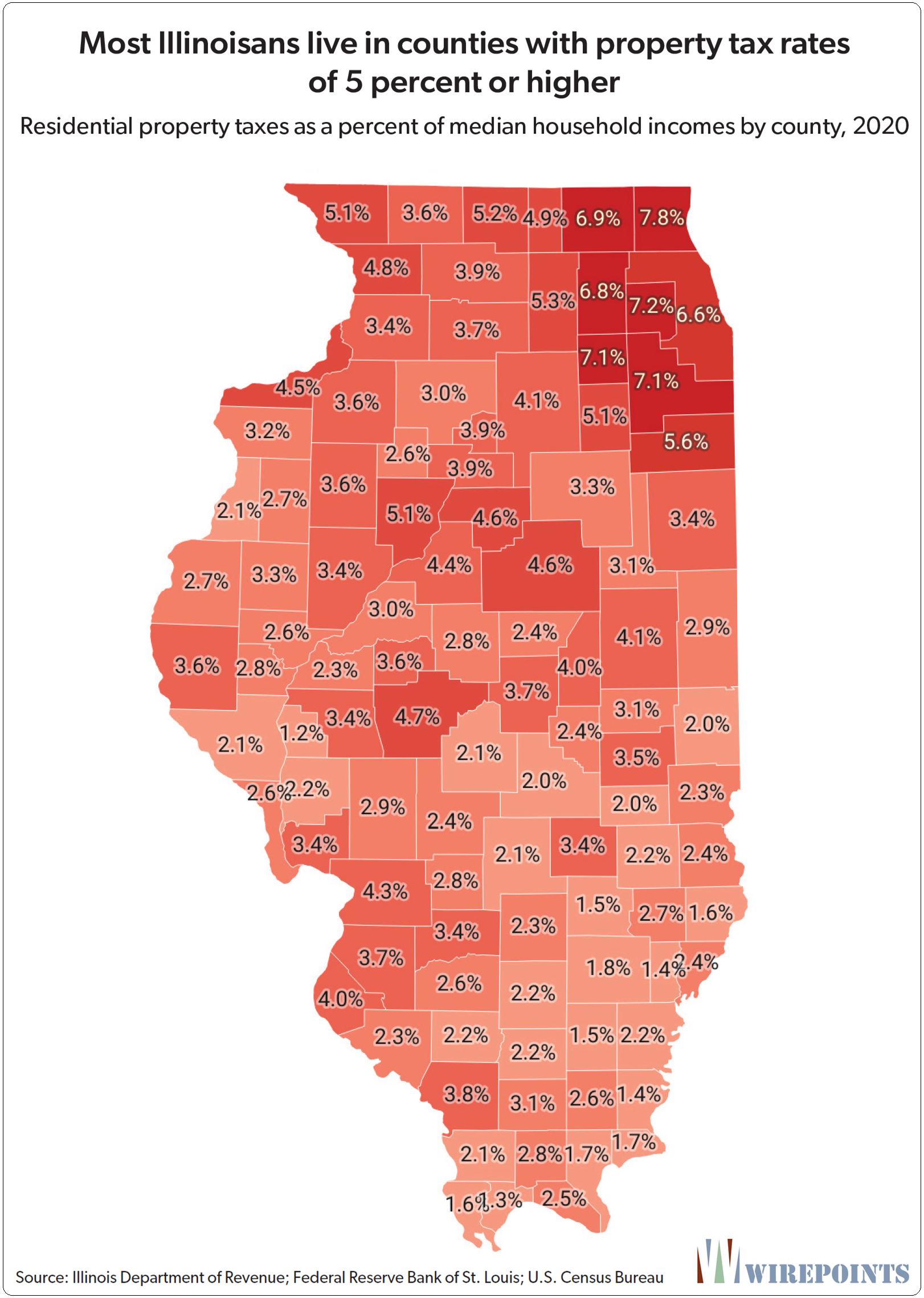

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Wirepoints Special Report Wirepoints

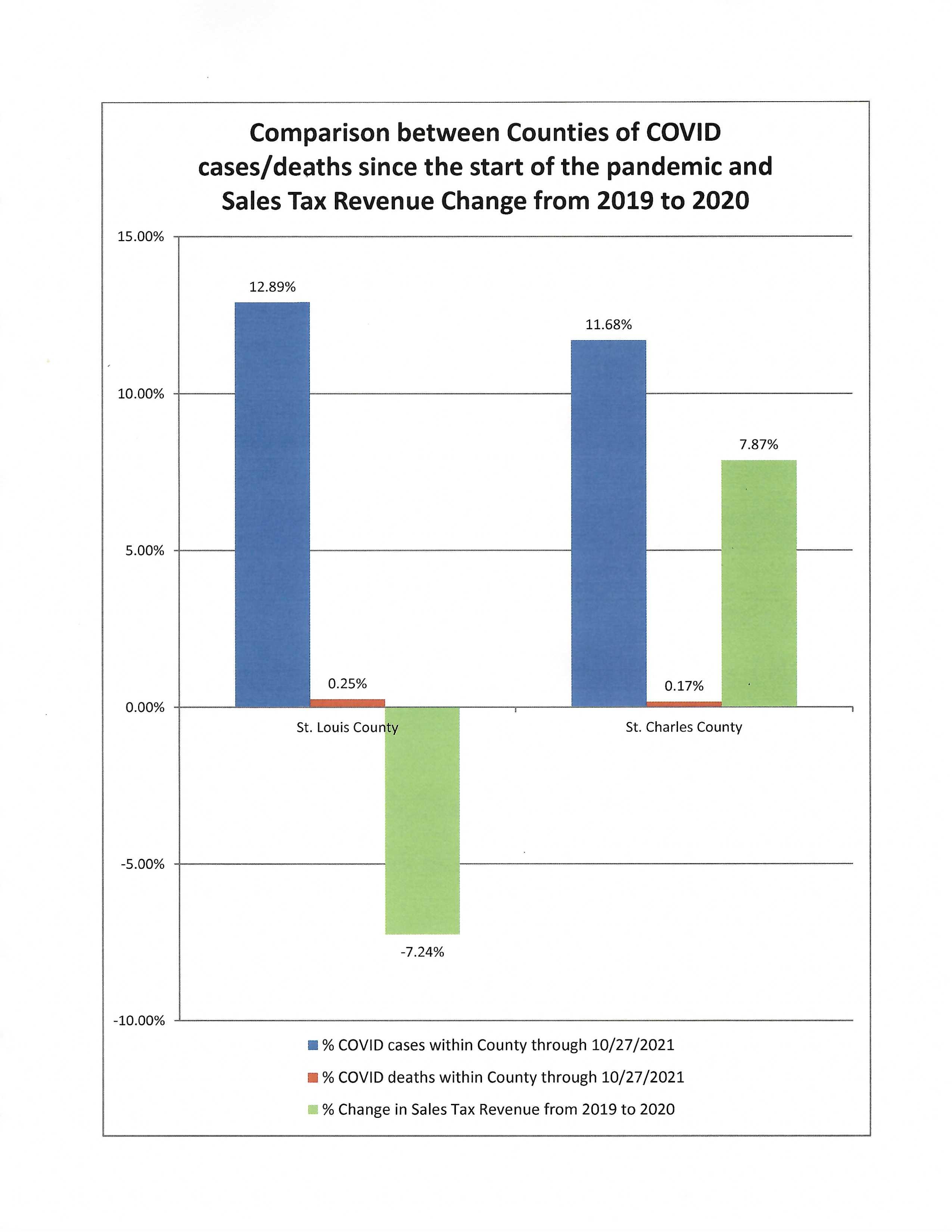

Tim Fitch On Twitter Impact Of St Louis Co Mandates Vs St Charles Co St Louis Co Has Recorded More Covid Deaths Amp Cases Per Capita Than St Charles County St

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Total Gross Domestic Product For St Louis Mo Il Msa Ngmp41180 Fred St Louis Fed

Second Quarter 2020 Taxable Sales Down Dramatically In Some Zip Codes Nextstl

Live By Loews St Louis Mo Officially Opens Its Doors Explore St Louis

Collector Of Revenue St Louis County Website

Interactive Maps Saint Louis County Open Government

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record

Missouri Income Tax Rate And Brackets H R Block

Missouri Shoppers Say Show Me Sales Tax Free Items Don T Mess With Taxes

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders